- The Pragmatic Investor

- Posts

- 🔍Don't Fall for These 7 Costly Trading Myths!

🔍Don't Fall for These 7 Costly Trading Myths!

7 Trading vs. Investing Myths That Could Cost You—Here's How to Get It Right

In my years of navigating the financial markets, I’ve seen many newcomers get confused by the terms "trading" and "investing." To the untrained eye, these might seem like different sides of the same coin—after all, both involve buying and selling assets, right? But dig deeper, and you'll discover that trading and investing are as different as night and day. The strategies, mindsets, and even the outcomes vary widely, yet misconceptions continue to cloud judgment, often leading to costly mistakes. Let's break down these myths one by one and set the record straight.

1. Trading Is Not Just Quick Investing—It’s a Different Game Altogether

One of the most pervasive misconceptions is that trading is simply a sped-up version of investing. This myth can be particularly damaging because it leads people to approach trading with an investing mindset, which is a recipe for disaster.

Trading is all about capitalizing on short-term market movements. The time horizon here can range from a few seconds to a few months, depending on whether you’re day trading, swing trading, or using another strategy. Unlike investing, which focuses on building wealth gradually over decades, trading requires quick decisions, constant monitoring of the market, and a deep understanding of technical analysis.

Investing, on the other hand, is a long-term endeavor. You buy an asset—be it stocks, bonds, or real estate—with the intention of holding it for years, if not decades. The goal is to grow your wealth steadily through compound interest, dividends, and capital appreciation. This distinction is crucial because it directly influences the risk management strategies you employ. For traders, stop-loss orders and strict exit strategies are essential, while investors may focus more on diversification and dollar-cost averaging.

2. "You Can’t Go Broke Taking Profits"—A Dangerous Oversimplification

There's an old saying in the trading world: "You can’t go broke taking profits." While it sounds prudent, this advice is dangerously simplistic. The reality is that taking profits too early can severely limit your gains, and this is one of the primary reasons many traders fail.

In trading, the timing of your exits is just as critical as the timing of your entries. Exiting too soon out of fear—whether it’s fear of losing the profit you've made or fear of an impending market downturn—can mean missing out on significant gains. For instance, if you bought a stock at $50 and sold it as soon as it hit $55, only to see it climb to $70, that’s a substantial missed opportunity. A disciplined exit strategy, based on market analysis and risk tolerance, is essential for long-term trading success.

3. Investing Isn’t Gambling—It’s Informed Decision-Making

Another widespread misconception is that investing is akin to gambling. This misunderstanding stems largely from the portrayal of the stock market in movies and the media, where it's often shown as a high-stakes game of chance.

The truth is, while both investing and gambling involve risk, the similarities end there. Gambling relies on luck and offers very little in the way of strategy or control over outcomes. When you place a bet, you're essentially putting your money on the line with the hope of a favorable result—if you win, you get a payoff; if you lose, your money is gone.

Investing, however, is about making informed decisions based on data, research, and analysis. You study a company’s financials, industry position, and growth prospects before deciding to invest. The goal is not to "win big" in the short term but to grow your wealth over time. Moreover, investing offers mechanisms to manage and mitigate risk—through diversification, asset allocation, and long-term planning. Unlike gambling, where the odds are often stacked against you, investing allows you to tip the scales in your favor through knowledge and strategy.

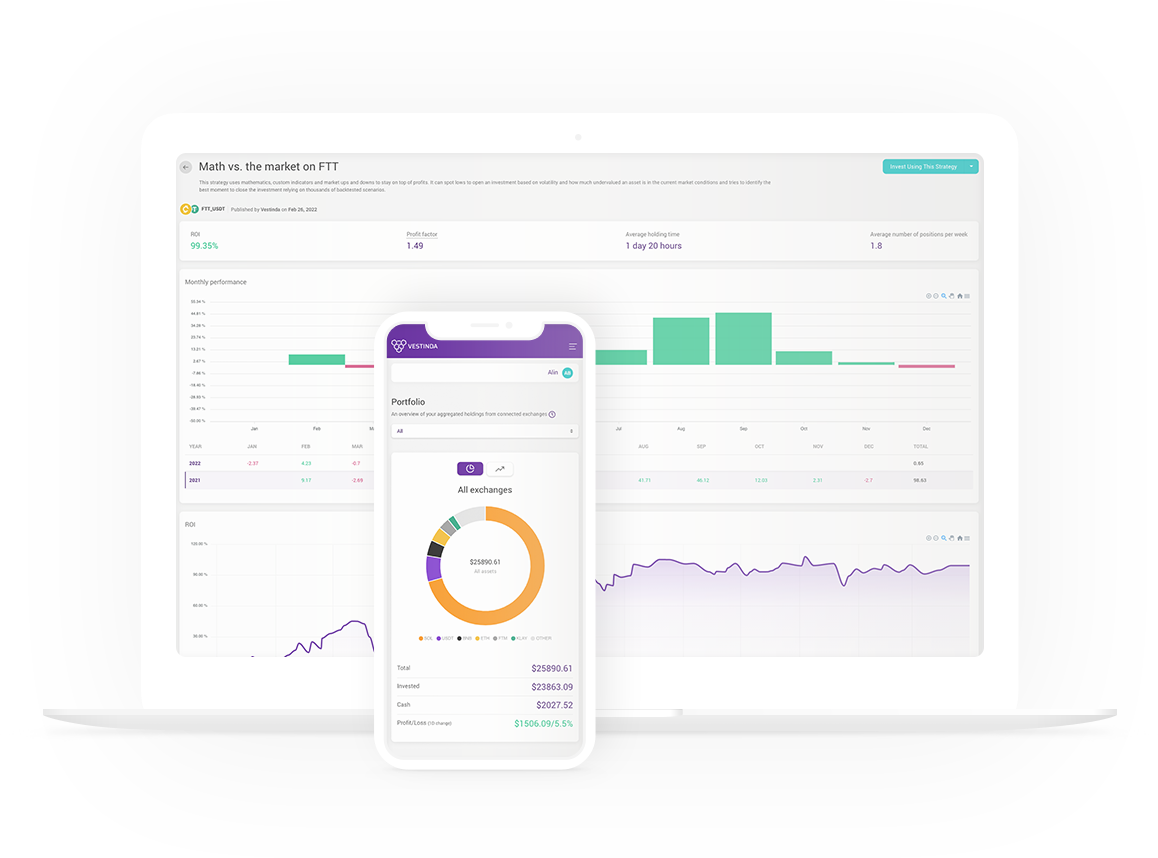

If you're serious about taking your trading strategies to the next level, I highly recommend checking out Vestinda. This platform offers a comprehensive set of tools that make backtesting not only accessible but incredibly efficient. With Vestinda, you can easily design, test, and refine your trading strategies across various asset classes using historical data. Whether you're a seasoned trader or just getting started, Vestinda’s user-friendly interface and powerful analytical tools can help you optimize your approach and improve your trading outcomes. Plus, as a special offer through this blog, you can start exploring Vestinda’s features for free—click here to get started!

4. Investing Is Not Just for the Wealthy—It’s More Accessible Than Ever

There’s a persistent belief that investing is the domain of the wealthy—that you need a substantial amount of money to get started. This might have been true decades ago when access to financial markets was limited, but the landscape has changed dramatically.

Today, thanks to technological advancements and financial innovation, anyone can start investing with just a small amount of money. Platforms like robo-advisors, micro-investing apps, and commission-free trading platforms have lowered the barriers to entry. You can now buy fractional shares of expensive stocks, meaning you don’t need thousands of dollars to invest in companies like Amazon or Google. Even with as little as $5, you can begin building a portfolio. The key to successful investing isn’t necessarily about how much you start with, but about starting early and being consistent.

5. Success in Trading Takes Time—It’s Not a Get-Rich-Quick Scheme

There’s a myth that successful traders are those who make a killing overnight, turning small sums into vast fortunes within days or weeks. This misconception is fueled by sensational stories of traders who "struck it rich" in a short period. However, these stories are the exception, not the rule.

In reality, consistent trading success requires years of practice, study, and experience. It’s not uncommon for new traders to experience significant losses before they start making consistent profits. Successful trading is a result of disciplined learning, continuous improvement, and the patient application of proven strategies. The road to becoming a proficient trader is long and filled with challenges, but those who stay the course and learn from their mistakes can achieve lasting success.

6. Market Timing Is Nearly Impossible—Time in the Market Is Key

Many new investors fall into the trap of trying to time the market—buying low and selling high based on short-term market movements. While this sounds good in theory, it’s nearly impossible to execute consistently. Even professional investors with decades of experience struggle to time the market accurately.

Instead, focusing on time in the market rather than timing the market is a far more reliable strategy. Long-term investors understand that markets are unpredictable in the short term but tend to rise over the long term. By staying invested, you can benefit from the power of compounding, which Albert Einstein famously called "the eighth wonder of the world." This means that the longer your money remains invested, the more it can grow—regardless of short-term market fluctuations.

7. There’s No One-Size-Fits-All Strategy—Customization Is Crucial

Finally, one of the most critical misconceptions is the belief that there’s a universal strategy that works for everyone. Whether you're trading or investing, it’s essential to recognize that what works for one person may not work for another. Your financial goals, risk tolerance, and time horizon are unique to you, and your strategy should reflect that.

For traders, this might mean developing a personalized trading plan that considers your risk appetite and market knowledge. For investors, it could involve a diversified portfolio tailored to your long-term financial goals. In both cases, understanding your own needs and crafting a strategy that fits those needs is crucial for success. Trying to mimic someone else's approach without understanding why it works for them can lead to frustration and poor results.

In conclusion, understanding the nuances between trading and investing is crucial for anyone looking to enter the financial markets. By dispelling these common myths, you can make more informed decisions, whether you're seeking the fast-paced world of trading or the steady path of long-term investing. Whatever route you choose, knowledge and strategy are your best allies in navigating the complex world of finance.

Found these insights valuable? Elevate your investing game by subscribing to our blog for more in-depth analysis, strategies, and market trends. Stay ahead with expert tips and refine your portfolio. Share this post with friends interested in the stock market and let's build a smarter investing community together!

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.

Reply