- The Pragmatic Investor

- Posts

- 👉💼Discover 25% Better Returns—backtest Now!

👉💼Discover 25% Better Returns—backtest Now!

I still remember that pivotal moment in my investing journey. It was a typical Friday evening, and I was going through my portfolio, trying to make sense of the inconsistent results. Some trades had been successful, but many others felt like they were more a result of luck than skill. I was frustrated, confused, and determined to find a better way.

That’s when I stumbled upon the concept of backtesting while reading a finance blog. At first, it sounded like one of those complex financial terms that only the pros use. But as I dug deeper, I realized it was a tool that could completely transform how I approached the market.

So, what exactly is backtesting? In layman’s terms, it’s like a time machine for your investment strategy. Imagine you have an idea for a new recipe. Before you cook it for a big family dinner, wouldn’t it be nice to know if the ingredients work well together? Backtesting is the cooking test—only here, the kitchen is the stock market, and the ingredients are your trading rules. You apply your strategy to historical market data to see how it would have performed in the past. This way, you can fine-tune your approach before you risk your hard-earned money in real-time trading.

Getting Started: The Tools I Used

Now that I understood what backtesting was, the next step was figuring out how to do it. I’m not a programmer, so I needed something user-friendly. After some research, I found a few platforms that made backtesting accessible even for someone like me who isn’t exactly tech-savvy.

TradingView was my first pick. It’s a popular platform known for its robust charting tools. What drew me in was its vibrant community—other traders sharing their strategies, tips, and even mistakes. It felt like I was part of a supportive group, all trying to figure out the market together. TradingView’s backtesting tool allowed me to apply my strategies to historical data, showing me detailed results on how they would have performed. It was like having a personal financial advisor that could rewind time and show me what worked and what didn’t.

For those who prefer to focus on long-term investing rather than daily trading, Stock Rover is another excellent option. While it doesn’t offer traditional backtesting like TradingView, it allows you to analyze historical stock data in a way that’s incredibly insightful. Imagine you’re a detective piecing together a case—Stock Rover gives you access to years of stock performance data, helping you see how certain criteria, like earnings growth or analyst ratings, would have impacted your returns. It’s like solving the mystery of what makes a stock successful.

My Strategy: From Hypothesis to Results

With the tools in hand, I was ready to test my first hypothesis. My idea was simple: focus on high-dividend yield stocks that also show strong earnings growth. But here’s the thing—before backtesting, this was just a theory. I had no idea if it would actually work in the real world.

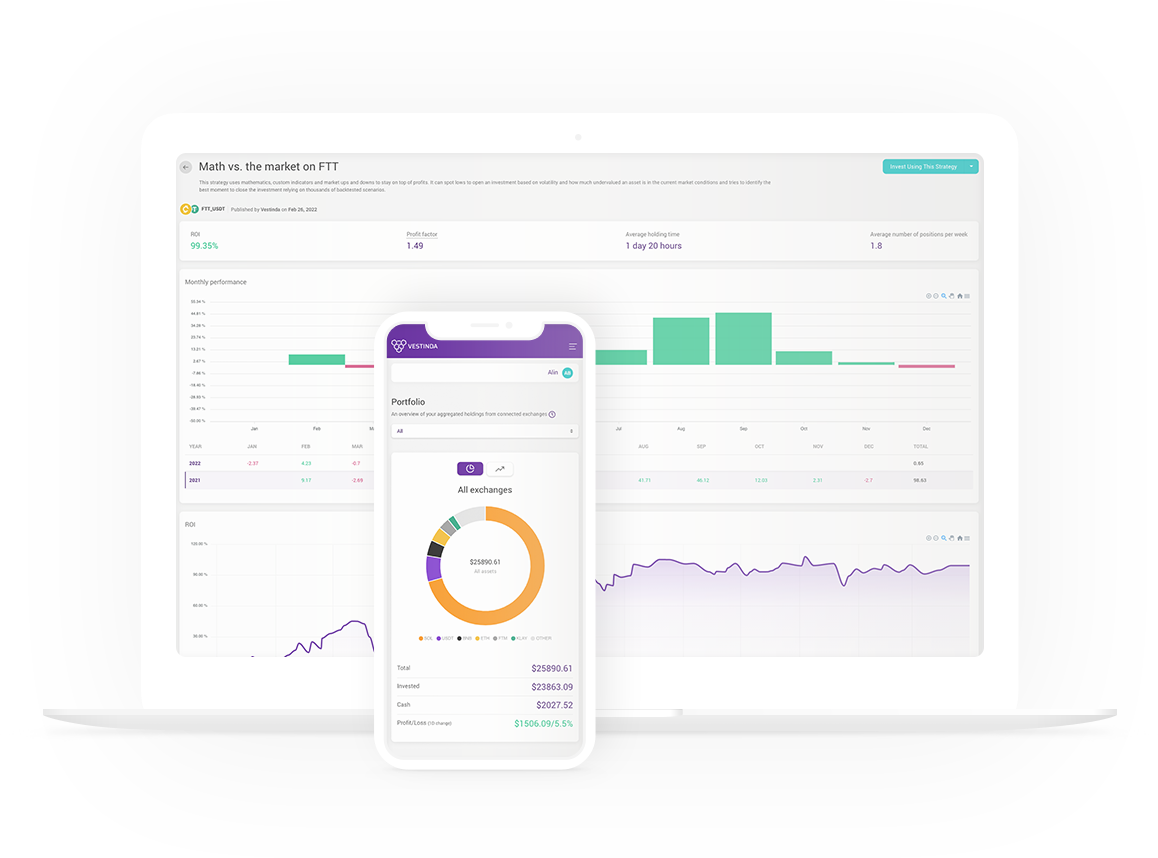

Using Vestinda, another fantastic platform that supports various asset classes, I started my backtesting journey. I input my trading rules—buy when a stock’s dividend yield exceeds a certain percentage and its earnings are growing year over year. Then, I let the platform simulate how this strategy would have played out over the past decade.

The results were surprising. My strategy would have performed quite well during certain market conditions but would have struggled during others. For instance, during periods of economic downturns, high-dividend stocks tended to drop more than I expected. This was a critical insight that led me to refine my approach—adding in rules to cut losses early during downturns and only reinvest when the market showed signs of recovery.

If you're serious about taking your trading strategies to the next level, I highly recommend checking out Vestinda. This platform offers a comprehensive set of tools that make backtesting not only accessible but incredibly efficient. With Vestinda, you can easily design, test, and refine your trading strategies across various asset classes using historical data. Whether you're a seasoned trader or just getting started, Vestinda’s user-friendly interface and powerful analytical tools can help you optimize your approach and improve your trading outcomes. Plus, as a special offer through this blog, you can start exploring Vestinda’s features for free—click here to get started!

The Payoff: Improved Returns and Greater Confidence

Once I had refined my strategy using the insights from backtesting, I was eager to put it to the test in the real market. This time, though, I wasn’t just throwing darts at a board; I had a clear, data-backed strategy that I knew had potential.

Over the next year, I closely followed my new plan. I stayed disciplined, sticking to my rules even when it was tempting to make emotional decisions. The difference was remarkable—my returns improved by 25% compared to my previous, more erratic methods. But the biggest gain wasn’t just financial. For the first time, I felt truly confident in my approach. I wasn’t just reacting to the market; I was proactively managing my portfolio with a strategy that I knew had been tested against years of market data.

This confidence can’t be understated. It’s one thing to hope your strategy works—it’s another to know it has a solid foundation in historical performance. I no longer second-guessed my decisions, and the stress of investing decreased significantly. Every trade I made was backed by a clear understanding of the risks and potential rewards.

Why You Should Start Backtesting Today

If there’s one piece of advice I can offer to anyone serious about improving their investment returns, it’s this: start backtesting your strategies. It’s not just a tool for professional traders; it’s a valuable resource for anyone looking to build a more reliable and effective approach to investing.

Backtesting won’t guarantee you’ll never lose money. The stock market is unpredictable, and there are always risks involved. But what backtesting does offer is a way to refine your strategies, understand your risk tolerance, and make more informed decisions. It’s like having a crystal ball that shows you how your ideas might play out, allowing you to adjust and improve before you put real money on the line.

So, take that first step. Explore platforms like TradingView, Stock Rover, or Vestinda, and see how your strategies hold up against historical data. You might be surprised at what you find. And who knows? You could be just a few backtests away from finding a strategy that significantly boosts your investment returns, just like it did for me.

Found these insights valuable? Elevate your investing game by subscribing to our blog for more in-depth analysis, strategies, and market trends. Stay ahead with expert tips and refine your portfolio. Share this post with friends interested in the stock market and let's build a smarter investing community together!

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.

Reply